I have many questions.

I'm about to draw up (literally) a chart showing how I'd like it to be setup.

I'm sure there are many regulations and laws to follow. I'll probably ask on a business themed site, but I do a lot of my online identity here, so I wanted to start here.

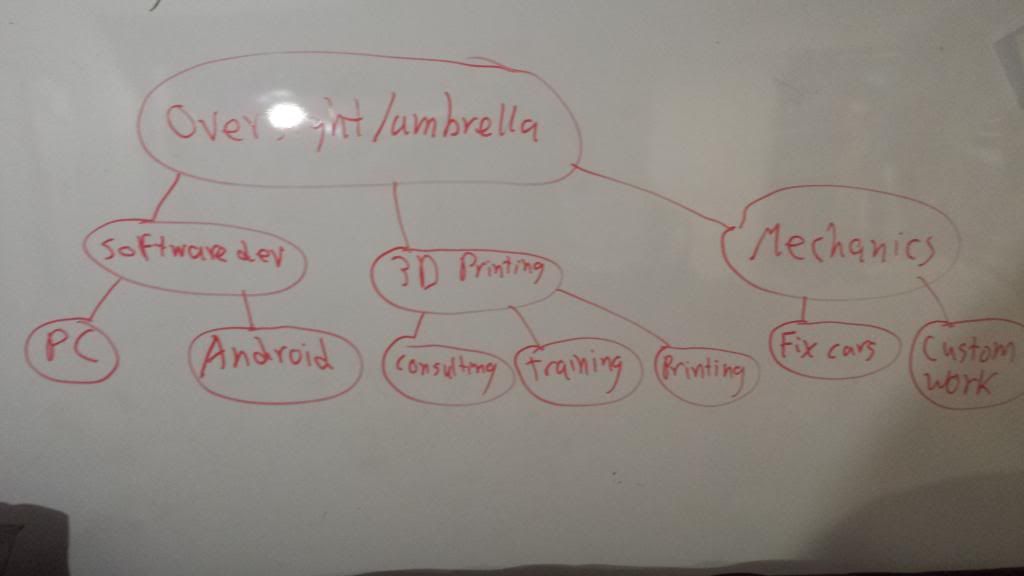

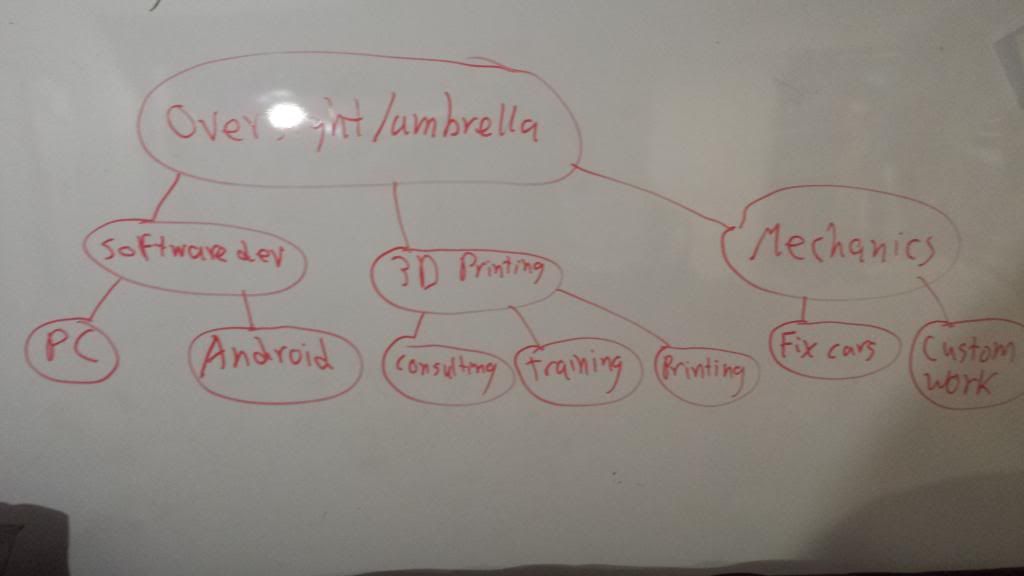

Think of it like this (with a graphic in bound):

There will be an ownership company that oversees all other businesses.

For sake of example, lets say I have 3 smaller businesses:

- Software development

- 3D printing

- Mechanics shop

I'd like most of them (specifically the software development one) to be setup to sell off portions of the company and various products.

So let's say software development makes PC and Android apps, and another company wants to come along and buy Android app A. They do, and I make much money and transfer all Android app A stuff to them.

They're impressed, and want to buy the Android development arm of software development. This is where I have more questions.

Let's say the Android arm is in the process of creating Android app B, and I've started writing down plans for Android app C.

Android app B would be transferred, but what if I'd like to keep Android app C?

Would I want to keep it in Software development company, or would I want to keep it in the oversight company that owns all 3?

If you know them, I'd like specifics about how to set these up.

(Picture forth coming for clarity)

I'm about to draw up (literally) a chart showing how I'd like it to be setup.

I'm sure there are many regulations and laws to follow. I'll probably ask on a business themed site, but I do a lot of my online identity here, so I wanted to start here.

Think of it like this (with a graphic in bound):

There will be an ownership company that oversees all other businesses.

For sake of example, lets say I have 3 smaller businesses:

- Software development

- 3D printing

- Mechanics shop

I'd like most of them (specifically the software development one) to be setup to sell off portions of the company and various products.

So let's say software development makes PC and Android apps, and another company wants to come along and buy Android app A. They do, and I make much money and transfer all Android app A stuff to them.

They're impressed, and want to buy the Android development arm of software development. This is where I have more questions.

Let's say the Android arm is in the process of creating Android app B, and I've started writing down plans for Android app C.

Android app B would be transferred, but what if I'd like to keep Android app C?

Would I want to keep it in Software development company, or would I want to keep it in the oversight company that owns all 3?

If you know them, I'd like specifics about how to set these up.

(Picture forth coming for clarity)

Comment