Is it possible? Can you each month transfer your dept to another card? I owe 5k and I'm just sick of it. I barely goes down although I put money on it all the time. I am a student and can't work that much and with my current pace, it'll never end. Anyway I think someone once told me it is possible but I wouldn't know for sure. If it isn't possible... Is there any other solution to pay it off faster? Thanks

Announcement

Collapse

No announcement yet.

Paying off a credit card with another credit card?

Collapse

X

-

I think I saw it on the news that the credit companies have been skyrocketing interest. Do you know what your interest rate is? Only advice I can think is to stay the course man. Pay it off, double up if you can. I've seen people pay off a credit card with a credit card but it is essentially the samre thing at the end with most likely a lil more interest..

-

From what I know In Canada in you have to cash advance it to pay it off, and you pay $5 or some % on the amount. If you could do that with no type of fee or loss on my part, I would have been doing that from the beginning to build my credit.

----------------My 92 Honda Accord LX---------------------- My 97 Nissan 240sx LE----

NE GUYS, Buy the last of my accord parts

Comment

-

I do it all the time. I had a $9000 balance last fall. It's down to $6000, because I switched it to a 0% interest card (buying a house and a new car, and not missing any payments on ANYTHING... does wonders for your credit!)

When this 0% promotion is up in April, I'm switching the balance to another one with that deal. I'll have it paid off in no time!

Comment

-

YES!!! You can do a balance transfer like devergoat said, to a lower interest card. FYI, usually after the first year or 6 mths of 0% interest, it will go up to some astrological amount %24 usually if your credit isn't so good.

Just call the card you wish to transfer the funds to, and they will take care of it.

Like 93accordcoupe said, a temporary solution to buy time, hope time is all you need in this one.

Comment

-

Not if you do a 0% interest rate, or at least a lower interest rate.Originally posted by 93accordexcoupe View Postit just seems like an escape for a little bit to me

I missed one payment, and Citibank jacked my interest rate up to 28%. I was paying $100 a month in interest alone! I did that for a year before I got smart and moved my balance to another card. So, basically, I spent $1200 last year for nothing. My balance transfer just saved me $600 for the past 6 months.

Comment

-

Has the addition of more credit cards affected your credit score?Originally posted by deevergote. View PostNot if you do a 0% interest rate, or at least a lower interest rate.

I missed one payment, and Citibank jacked my interest rate up to 28%. I was paying $100 a month in interest alone! I did that for a year before I got smart and moved my balance to another card. So, basically, I spent $1200 last year for nothing. My balance transfer just saved me $600 for the past 6 months.

"The fault-finder will find faults even in paradise. Love your life, poor as it is. You may perhaps have some pleasant, thrilling, glorious hours, even in a poorhouse."-Henry David Thoreau

Comment

-

Even though they offer this option, i believe it to be very bad and of poor judgement.

I mean it isn't responsible to even have debt in the first place but i understand things happen.

I had a CC bill for a while and now im down to around $1100. I just keep making payments and doing what i can.

Transferring it over, while it may temporarily assist you, won't get rid of it and it is a BAD habbit.

Comment

-

i agree this is a poor choice but done very sparingly (like in emergencies) it does work, but you need to really keep on top of it because like deever said the low interest cards that you can transfer your balance to will shoot up 20+% next time you sneeze.

another thing to think is that if your credit is poor, youre less likely to be approved for a new card, or for a limit useful enough to even make it worthwhile. and the more you attempt, the more it hurts.

consolidation loans are probably the best option, IMO... get that debt AWAY from the credit card company, not passed to another one.

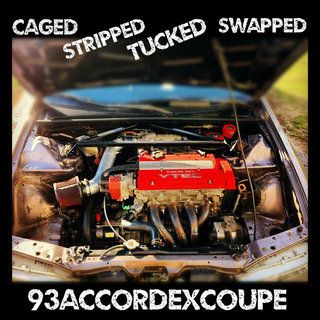

targeted ads generally do that.Originally posted by Ralphie View Post[PIC]

Just thought that was ironic.Last edited by cp[mike]; 01-23-2009, 09:12 PM.

- 1993 Accord LX - White sedan (sold)

- 1993 Accord EX - White sedan (wrecked)

- 1991 Accord EX - White sedan (sold)

- 1990 Accord EX - Grey sedan (sold)

- 1993 Accord EX - White sedan (sold)

- 1992 Accord EX - White coupe (sold)

- 1993 Accord EX - Grey coupe (stolen)

- 1993 Accord SE - Gold coupe (sold)

Current cars:

- 2005 Subaru Legacy GT Wagon - Daily driver

- 2004 Chevrolet Express AWD - Camper conversion

Comment

-

Not that I'm aware of. My credit score only dropped by a few points (from 760 to 730 I think) over the year... and I missed that one card payment. I think I may have had a late car payment or two as well. Only a few days, but it all depends on when they report me. I never got a credit report to see what was happening.Originally posted by IAmTheNight View PostHas the addition of more credit cards affected your credit score?

Comment

-

HmmmmOriginally posted by deevergote. View Post

We should make a thread about dildos and see what ads come up.

Comment

That's what Google does.

That's what Google does.

Comment